Tally 9.0 - What is Debit / Credit?

Somebody asked a basic question in Tally. In fact it is question in financial accounting. What is debit or credit in Tally? In accounting practice a single transaction is done by making two entries. One party is giving the amount and another is receiving. The giver's account is credited and receiver's account is debited.

The basic rule is Debit the receiver and credit the giver, debit what comes in and credit what goes out. For example if a customers buy goods/service and paying his bill. His account will be credited and cash / bank account will be debited.

The basic rule is Debit the receiver and credit the giver, debit what comes in and credit what goes out. For example if a customers buy goods/service and paying his bill. His account will be credited and cash / bank account will be debited.

Debit, Credit - Single/Double entry

Configure single/double entry for payment, receipt and contra

Somebody asked me he is not getting debit credit entry fields in payment/receipt vouchers. Tally 9 by default is set to single entry for payment, receipt and contra. That means you will select a single that is to be credited or debited (for payments credited, for receipts debited) then you will select the accounts to be credited (for receipts) or debited (for payments). This is the single entry mode in Tally.

For example if you are making a payment you will first select a Cash or bank account and in the particulars you will select a supplier (for example). and on the right hand side you will enter the amount of payment. This method is simple and convenient. However if you want double entry system you can still use it by configuring Tally.

To do this open Accounting Vocher Creating screen (F5: Payment, F6: Receipt). Press F12: Configure. Give No to Use Single Entry mode for Pymt/Rcpt/Contra. Now you will have both debit and credit fields.

Learn Tally 9 in Hindi

Tally in Hindi With Google Translate

Google offers a wonderful tool to translate web pages from one language to others. Many people wish to learn tally (Indian Accounting package) in their own language. Many people asked me to provide the tutorial in Tamil, Malayalam, Kannada, Telugu and Hindi. I can write in all these languages. I can write only in English and Tamil. But Google a offers a translation tool to translate to many languages.

I have used the tool in my blog. You can find the translate option in bottom right hand side of this blog. Enjoy! Now learn Tally in Hindi!!

New Financial Year Creation in Tally

How to split company Data?

For each financial year we want to keep separate data. When a financial year ends we want to put the closing balance of previous year as opening balance of new year. It tally it is easy to create new financial year by splitting company data.For example if your current financial year is 1-4-2010. At the end of 31-3-2011 you will want to open new account. So ledger balances will be carried over. Voucher numbers will start with number 1.To do this use the 'Split Company Data' option in tally.

Here is the step-by-step guide create new year:

Open Tally 9. Open the company you want to split. Press Cmp. Info (Alt+F3) button on the right hand side.

You will get the above screen select 'Split company Data'.

Give the beginning date of new financial year. Usually April -1 is the commencement of new financial year in India. So give that date. press enter. Now you will have two companies First Company and Second Company. Your Original data will be retained.

Narration for Each Entry in Voucher

How to configure to use narration for each entry?

Someone asked me to show how to configure tally to enter narration for each entry. If you set this option tally will show a narration field for each ledger involved in voucher. This option should be set for the voucher type you wish to set. For example if want narration for each entry in payment voucher, you have to alter payment voucher to set this.

In the Gateway of Tally select Masters -> Accounts Info -> Voucher Types -> Alter. List of voucher types will open. Select a voucher type to set narration for each entry. For example select payment voucher and give yes to Narrations for each entry.

Now when you make payment voucher you will be asked for narration for each ledger.

BRS - Bank Reconciliation in Tally

How to get BRS Reports in Tally 9?

What is BRS? In accounting terminology BRS stands for Bank Reconciliation Statement. For example you make a payment by issuing a bank check to a party / supplier. What will happen to the check. The transaction will not reflect immediately in your bank. The party will first deposit the check on or after the date mentioned on the check. Then it will take further one-three days for the check to clear depending on the bank. But your voucher entry in Tally is on prior date. So your bank ledger in tally may be showing wrong balance, not the actual balance. You don't know what happened to the check. Whether it is cleared or not? After getting your bank statement you will make reconciliation entry. Thus you will get actual bank balance.

In Tally 9 there is an option to enter the bank date. Tally will show two balances in reconciliation statement. The Balance as per company books. And amount not reflected in Bank, and Balance as per Bank.

Whatever voucher entries you make (Payment/Receipt/Contra etc) will be reflected in Balance as per company books. For whatever vouchers you make BSR entry will be shown in Balance as per bank. The difference between the two is given as Amount not reflected in Bank.

We will see this with the following examples and screen shots.

Now the Balance as per company books is Rs. 1000

Amounts not reflected in Bank is Rs.1000

Balance as per Bank is Rs.0

I gave the check on 11.june.10. If the check clears on 13.june.10 i give that date under Bank Date column. Now the Bank account will tally

Examples of Standard Narration for voucher entry

During voucher entry Tally will ask you to enter narration. Though narration entry is not mandatory it is good practice to give descriptive narration. Here are some examples for giving narration.

In the payment and receipt vouchers tally by default will ask for cheque number by prompting Ch. No.: Here just type the cheque number and date for your reference.

In sales/purchase vouchers you can give whatever you wish to remember.

In the payment and receipt vouchers tally by default will ask for cheque number by prompting Ch. No.: Here just type the cheque number and date for your reference.

In sales/purchase vouchers you can give whatever you wish to remember.

Voucher Entry - Basic Vouchers in Tally

Particulars

If you create Accounts voucher

In this field you should specify Dr or Cr. Type the letter D or Dr over the existing prompt to change, then select the ledger name from the pop-up list that Tally opens. There may be multiple Debit and Credit entries in one single voucher.

If you create Inventory voucher

If you are creating inventory voucher in Tally you will give information about the stock item you receive or issue and item related details like the Godown/warehouse, Batch Details, Quantity, Rate, Amount etc.

Debit / Credit Amount:

This field appears in Accounts voucher only. Enter the amount of transaction and press Enter key. Tally will update current balance of the ledger and display it. This will happen only if you gave 'Yes' to the question 'Show Ledger Current Balance?' under Accounting Voucher in Vouchers Entry under F12: configure option. The total will appear on the bottom of the Debit and Credit columns. If both credit and Debit totals are not equal Tally will prompt to enter further Credit / Debit to balance the voucher. If both are equal Tally will move the cursor to Narration field.

The Narration field

The last field of Voucher is Narration, here you enter details of the transaction entered in the voucher. It is not mendatory / compulsory to give narration. You can type anything about the transaction or just leave this field blank. You can turn off narration by responding No to the question 'Use Common Narration?' at voucher creation/alteration screen.

Saving the Voucher:

After entering narration, when you press Enter key a confirmation prompt will appear Asking 'Accept Yes/No?'. Press Y or Enter to save the voucher or press N to return cursor to the first entry allows you to alter any data in the voucher. If you give Y Tally will save the voucher and blank screen will appear next to continue voucher entry.

Voucher Types in Tally:

Payment voucher:

The payment voucher is for all payments you make through cash or Bank. These payments can be towards expenses, purchases, to trade creditors, etc. Follow the below procedure to create a payment voucher.

All payment vouchers must have first entry a debit and at least one credit to a Cash or a Bank Account. You can have any number of debit and credit entries. However, if you do not credit one cash or bank account and still try to accept the voucher a message appears asking for a cash or bank account.

If configured, Fund Transfer entries can also be made in payment voucher.

If you have given Yes to 'Print After Saving Voucher?' in Voucher Type creation/Alteration Tally will print the voucher immediately after saving.

Receipt Voucher

The receipt voucher in Tally is for all receipts into the Cash/Bank account. The voucher is similar to the payment voucher except that you debit cash or bank A/cs and credit the ledger from which you receive. The first entry in receipt must be credit and at least one debit to a cash or bank account. There can by any number of debit and credit entries. If you do not debit one Cash or bank account, a message appears asking you to rectify the entry.

If you have given Yes to 'Print After Saving Voucher?' in Voucher Type creation/Alteration Tally will print the voucher immediately after saving.

Alternatively you can print any voucher later by going to Voucher Alteration screen using Display menu. Open the voucher and press Alt-P to display the 'Print Voucher' Screen. Give 'Y' to the Print? Prompt.

Sales Voucher

The first entry must be a debit involving any debtor, bank or cash account and second should be a credit to ledger placed under sales account group. Rest of the accounts may be any Revenue account or any account under the Group current liabilities. Thus you can include Duties&Taxes from 3rd entry onwards.

Purchase voucher

The first entry must be a credit involving any creditor, Cash or Bank account and second entry should be a debit to a ledger placed under purchase account group. Rest of the accounts may be any revenue account or any account under the Group Current Liabilities

Contra Voucher

The contra voucher is for Fund transfers between cash and Bank accounts only. The following is the rule,

For example, If you pay Rs. 10000 cash into State bank Account. Your contra entry should be like this,

Particulars Debit/credit

Cr. Cash Credit - 15000

Dr. State bank ac Debit - 15000

Credit Note:

Credit Note is raised when a buyer reutrns some goods that you sold him. or you give him credit due to rate difference or discount/rebate or when there is an exces debit to any party

Debit Note:

You create a Debit Note when you make purchse return or when you have shortbilled a customer or you are granted credit by your supplier due to rate difference, discount etc.

Memo Voucher

This is purely Non-accounting voucher. These entries will not affect your accounts nor does affect your final results. You can alter and convert a Memo Voucher into a regular voucher when you decide to bring the entry into your books.

You can use memo vouchers to make suspense payments, vouchers not verified at the time of entry, Items given on approval.

If you create Accounts voucher

In this field you should specify Dr or Cr. Type the letter D or Dr over the existing prompt to change, then select the ledger name from the pop-up list that Tally opens. There may be multiple Debit and Credit entries in one single voucher.

If you create Inventory voucher

If you are creating inventory voucher in Tally you will give information about the stock item you receive or issue and item related details like the Godown/warehouse, Batch Details, Quantity, Rate, Amount etc.

Debit / Credit Amount:

This field appears in Accounts voucher only. Enter the amount of transaction and press Enter key. Tally will update current balance of the ledger and display it. This will happen only if you gave 'Yes' to the question 'Show Ledger Current Balance?' under Accounting Voucher in Vouchers Entry under F12: configure option. The total will appear on the bottom of the Debit and Credit columns. If both credit and Debit totals are not equal Tally will prompt to enter further Credit / Debit to balance the voucher. If both are equal Tally will move the cursor to Narration field.

The Narration field

The last field of Voucher is Narration, here you enter details of the transaction entered in the voucher. It is not mendatory / compulsory to give narration. You can type anything about the transaction or just leave this field blank. You can turn off narration by responding No to the question 'Use Common Narration?' at voucher creation/alteration screen.

Saving the Voucher:

After entering narration, when you press Enter key a confirmation prompt will appear Asking 'Accept Yes/No?'. Press Y or Enter to save the voucher or press N to return cursor to the first entry allows you to alter any data in the voucher. If you give Y Tally will save the voucher and blank screen will appear next to continue voucher entry.

Voucher Types in Tally:

Payment voucher:

The payment voucher is for all payments you make through cash or Bank. These payments can be towards expenses, purchases, to trade creditors, etc. Follow the below procedure to create a payment voucher.

All payment vouchers must have first entry a debit and at least one credit to a Cash or a Bank Account. You can have any number of debit and credit entries. However, if you do not credit one cash or bank account and still try to accept the voucher a message appears asking for a cash or bank account.

If configured, Fund Transfer entries can also be made in payment voucher.

If you have given Yes to 'Print After Saving Voucher?' in Voucher Type creation/Alteration Tally will print the voucher immediately after saving.

Receipt Voucher

The receipt voucher in Tally is for all receipts into the Cash/Bank account. The voucher is similar to the payment voucher except that you debit cash or bank A/cs and credit the ledger from which you receive. The first entry in receipt must be credit and at least one debit to a cash or bank account. There can by any number of debit and credit entries. If you do not debit one Cash or bank account, a message appears asking you to rectify the entry.

If you have given Yes to 'Print After Saving Voucher?' in Voucher Type creation/Alteration Tally will print the voucher immediately after saving.

Alternatively you can print any voucher later by going to Voucher Alteration screen using Display menu. Open the voucher and press Alt-P to display the 'Print Voucher' Screen. Give 'Y' to the Print? Prompt.

Sales Voucher

The first entry must be a debit involving any debtor, bank or cash account and second should be a credit to ledger placed under sales account group. Rest of the accounts may be any Revenue account or any account under the Group current liabilities. Thus you can include Duties&Taxes from 3rd entry onwards.

Purchase voucher

The first entry must be a credit involving any creditor, Cash or Bank account and second entry should be a debit to a ledger placed under purchase account group. Rest of the accounts may be any revenue account or any account under the Group Current Liabilities

Contra Voucher

The contra voucher is for Fund transfers between cash and Bank accounts only. The following is the rule,

For example, If you pay Rs. 10000 cash into State bank Account. Your contra entry should be like this,

Particulars Debit/credit

Cr. Cash Credit - 15000

Dr. State bank ac Debit - 15000

Credit Note:

Credit Note is raised when a buyer reutrns some goods that you sold him. or you give him credit due to rate difference or discount/rebate or when there is an exces debit to any party

Debit Note:

You create a Debit Note when you make purchse return or when you have shortbilled a customer or you are granted credit by your supplier due to rate difference, discount etc.

Memo Voucher

This is purely Non-accounting voucher. These entries will not affect your accounts nor does affect your final results. You can alter and convert a Memo Voucher into a regular voucher when you decide to bring the entry into your books.

You can use memo vouchers to make suspense payments, vouchers not verified at the time of entry, Items given on approval.

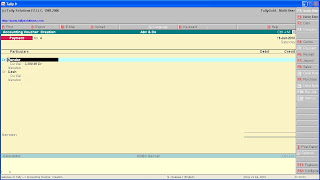

Voucher Entry

Lesson 5 - Voucher Entry Basics

Account Voucher

Voucher is a document containing the details of a transaction. For every transaction, you make a voucher. The voucher entry option at the Gateway enables you to make your day-to-day entries.

Voucher Entry in Tally 9

To make your voucher entries, press V at the Gateway. This brings you the Voucher Creation screen as shown in Figure.

F12: Configure: At any voucher screen, when you press F12: Configure, you get a screen as shown to configure your options.

The options are classified under two sections, namely

Accounting Vouchers, Inventory Vouchers

Now we will discuss accounting vouchers,

Show Cost Centre Details?

If you want to allocate transactions to Cost Centres, set this option to yes which will pop-up a window for cost allocation during Voucher entry.

Show Inventory Details?

If you want to input Inventory Details in Vouchers like Sales or Purchase, set this option to Yes which will pop-up a window for Inventory allocation during voucher entry.

Show Table of Bills details for Selection?

Normally, the list of Outstanding Bills appear when you make any transaction relating to ledger for which Bill by Bill option is set to Yes, and you select Ag Ref, so that you can pick up the Bill you want to adjust. However, if there is long outstanding list it may slow down the pace of voucher entry. To prevent the Outstanding Tables from being popped up during Data Entry, set this option to No, to speed up data entry.

Show Bill-wise Details?

If you want to input Billwise details in Vouchers for the ledgers for whom you have set yes to maintain bill wise details, set this option to Yes which will pop-up a window for Billwise allocation during Voucher entry.

Expand into multiple lines?

In the bill wise details, if you wish to view another line displaying the due date of the bill also, se this option to yes.

Show Balance as on Voucher Date?

If you have set the previous option to Yes, current balance of the ledger as at end-of-period will be displayed. If you turn this option to yes, Current Balances as at voucher date will be shown during Voucher entry, instead of end-of-the period. This is particularly helpful if you enter vouchers of previous date when you want display of balance for the ledger as at the Voucher date instead of end-of-the period.

Use Payment/Receipt as contra?

Normally Fund Transfer transactions are entered in contra Voucher, however, if you prefer to record such transactions in payment / receipt vouchrers, set this option to yes (e.g when you transfer fund through bank draft / DD and pay bank charges, a payment voucher will be more convenient than contra voucher)

A note of caution here. Normally you should make fund transfer entries through contra voucher only, unless you have specific reasons to do otherwise. When you use Receipt or Payment vouchers for fund transfer, stick to a particular voucher type otherwise you may get partial or wrong report when you view for a specific type of voucher.

Allow cash Accounts in Journals?

Norally cash transactions are recorded in Contra, Receipt or Payment Vouchers and such entries are not permitted in Journal Vouchers which are exclusively used for adjustments between Ledgers other than Cash and Bank Accounts. However, if you wish to pass a journal Voucher involving cash / bank Ledger, set this option to Yes.

Use Cr/Dr instead of To/By during Entry?

By default To and By appears during Tally Voucher entry, however if your preference is Cr & Dr, set this option to Yes

Warn on Negative Cash Balance?

During Vouchers entry if you want a warning when cash balance becomes negative, set this option to Yes.

Pre-Allocate Bills for payment?

Normally, you first enter the total amount paid/received and then select the Bills adjusted. By turning this option to Yes, you can first select the bills during Payment Voucher Creation. In such case, while entering a party account in a Payment Voucher, the list of outstanding bills come up to select the bills to be adjusted, simplifying the task of making payments without pre-calculating the total of the bills.

Allow Expenses/Fixed Asset in Purchase Vouchers?

Purchase Vouchers are normally allowed to include Direct Expenses (when this option is set to No). To allow Fixed Assets and Indirect Expenses also, set this option to Yes.

Allow Income Accounts in Sales Vouchers?

Sales Vouchers will be allowed to include Direct / Indirect Incomes by setting this option to Yes.

The voucher Creation Screen

Top portion of voucher Creation window displays the name of the company for which you are creating the voucher (Current company)

Description of items on the voucher screen:

Type of Voucher: Top left corner of the screen displays the selected type of Voucher. To select any other Type of Voucher, press relevant button. Different Types of Vouchers will be explained in detail.

Voucher Number: Just after the Type of Voucher, Number of the Voucher is displayed. If automatic numbering was set for the selected voucher type, it would be generated automatically and cursor would not move to this field. By default automatic voucher numbering is enabled in Tally 9. If manual numbering has been set cursor will move to the voucher number field to input number from keyboard.

Reference: This field appears in all types of vouchers except receipt, payment, journal, Reversing Journal and Memorandum Vouchers. It's a free field where you may input any reference relating to the Voucher. For example, you may enter Order Number, or Invoice number,in Purchase, Delivery challan number in sales voucher.

Date of Voucher: Date of the Voucher is displayed at top right corner of the screen which indicates date of voucher entry. The Current Date at Gateway of Tally is taken by default as date of voucher. To change the date, press F2 on keyboard.

Effective Date: This is the date which is considered for the computation of Due Date /Interest. This field appears if you have set Yes to the option, Use Effective Date for the specific voucher. Date of Voucher and Effective Date may be different. Also to change Effective Date, press F2 button that prompts Effective Date below Current Date.

Tally 9, Lesson 4

Tally 9 Lesson 4 - Inventory Master

Inventory Info Menu contains the following masters to manage Inventory in Tally 9.

- Stock Groups: Group the Stock Items

- Stock Categories: Parallel Stock Groups

- Stock Items: Actual Stock items which move

- Godowns: Storage locations of the Stock Items

- Budgets: Budgets for different requirements

- Voucher Type: Various Voucher Types

- Units of Measure: Simple & Compound UOMs

Normal and Advanced Information

Information is Masters are classified into 2 modes: Normal and Advanced. Normal information can always be entered. Advanced information can be entered only if Allow Advanced entries in Masters? Is set to Yes in F12: Configure

F12 : Configure -> Inventory Masters: Explanations

Allow ADVANCED entries in Masters?

Like Accounts Masters, you can work in Normal modes or Advanced modes for Inventory masters. Set Yes to work in Advanced mode

Use PART NUMBERS for stock Items?

To specify Part No for Stock Items, set to Yes which will prompt a field for Part No. at the time of creation of Items.

Use Description for Stock Items?

If you wish to input description for Stock Items, set to Yes which will cause a prompt to appear for items.

Specify Default Ledger allocation for Invoicing?

Stock Items can be given default Accounts Ledger accounts for both Sales and Purchase Invoices, which will further simplify entry of data through the Voucher Class mechanism for Sales / Purchase.

Use REMARKS for Stock Items?

If you require additional space for detailed description for stock Items, set to Yes which will prompt a t the time of creation of items.

Use ALTERNATE UNITS for Stock Items?

If any stock item is measured in more than one Unit of Measure, set to Yes. Tally will prompt for Alternate Unit at the time of creation of items.

Allow standard Rates for Stock Items?

If you wish to enter standard Cost Price and Selling rates, set to Yes. Tally 9 will prompt at the time of creation of items.

Allow component list details (Bill of Materials) ?

If you wish to input component details for any item set to Yes and Tally will prompt at the time of creation of item.

Use ADDRESSES for Godowns?

If you require to specify Godown address, set to Yes to get a prompt at the time of creation of Items.

Stock Group

You can classify all stock items into Stock Groups based on common feature, based on brand, quality, specification etc. For example a computer dealer may create Stock Groups like Hard Disk, Monitor, Keyboard etc. Again sub-groups may be created in each group e.g SATA Disk, IDE Disk. Thus you can nest groups to any level.

Here is an example of Stock Groups for Computer Dealers. In Stock Groups, Sub-Groups & Stock Items are presented in a hierarchical manner.

Hard Disk

SATA DISK

Seagate 80 GB

Seagate 160 GB

Samsung 250 GB

IDE DISK

Seagate 80 GB

Monitor

CRT Monitor

LG 15 inch

LG 17 inch

TFT Monitor

Samsung 15 inch

Sony 15 inch

Creation of Stock Group

Name: Enter name of the Stock Group

Alias: Enter optional alias or alternate name

Under: Al list displaying existing Groups appears to select from. To create Primary Group, select Primary.

Can Quantities of items be ADDED?

Give yes to this question if all stock items under it can be summed up. If it is not desired, set to No

Stock Categories

Stock Categories offer the benefit of classifying an Item in another dimension.

The concept of Stock Categories may be utilized in effective way once you have understood its implication and how to implement it in your context. You have the facility, it is incumbent upon the user to utilize it. If not properly planned, it may cause wastage of time.

Creation of Stock Categories

Name: Enter the Name of Stock Category

Alias: Enter an alternate name (optional)

Under: A list displaying existing categories appears to select from. To create Primary level group, select Primary.

Stock Items

Stock items are the actual items for which you wish to maintain Accounts. Like Accounts ledger, Stock Items are accounted for.

Creation of Stock Items

Name: Type the name of the Stock Item.

Alias: Alternate name

Part No: This field will appear if you have configured so under F12: Configure. Use Part Numbers for Stock items?.You can give Part No, Style No, Design No, Bin-Card No etc.,

Alias: Alternate for Part No.

Description: This option will be available if you have activated the option Use Description for Stock Items? Under F12: Configure. You can give descriptive details for stock Items which will be optionally printed in Invoice also.

Under: Select the Stock Group under which the Item should be placed. If you want to create the item independent of any Stock Group, select Primary here.

Category: This field appears if you activated Stock Category under F11: Features. Select the Stock Category from pop-up for the Item you are creating. If you do not want to categorize the item Select Not Applicable from list

Remarks: This field appears if you have configured so under F12: Configure. Enter Remarks for the Item so that while looking for the item you will get this additional information. You can also write information about the item.

Units: Select Unit of Measure applicable for the Item. You can skip it by selecting Not Applicable from the list.

Alternate Units: If you configure under F12: Configure, this additional option is available. Enter alternate Unit of measure for the item.

Maintain in Batches?

If you activate under F11: Features, this option is available. Respond yes for those items you wish to track batch-wise details.

If you set Maintain in Batches to Yes, you get the following additional options,

Track Date of Mfg.? Give Yes if you require to track date of manufacturing for the item.

Use Expiry Date? Give Yes to set expiry dates for items (Applicable to drugs/medicines)

Enter Standard Rates?

This option will appear if you have configured under F12: Configure Allow Standard Rate for Stock Items.

You may value your Closing Stock in different methods including Standard Purchase Cost or Standard Sales Price. These rates may vary periodically.

By setting Yes, you can enter Standard Purchase Cost and Sales Prices on different dates.

Also you must select a Unites of Measure in order to give rates.

These rates becomes standard price list rates, i.e., while entering sales or purchase entries for this item, rates of the day will be automatically picked up.

Rate of Duty: Specify Rate of Duty applicable for the Item

Tariff Classification: Enter Tariff classification under which the item falls. This field will appear when you enter a valid value in the Rate of Duty above.

Set Components (BoM) ?

For items which are manufactured or assembled if you wish to input component details (Bill of Materials) set Yes. Which pops up a screen to enter component details.

Opening Balance: Enter opening stock details for the item. If you have activated all the features, you will be asked to enter Quantity, Godown, Batch/Lot No., Rate, Per and Value. You can split opening stock into multiple batch-wise, Godown wise.

Advanced Information

If you set Allow Advanced entries in Masters under Inventory Masters in F12: Configure to Yes, you may specify following additional information.

Costing Method: For default closing stock value, select one of the Valuation method from the pop-up list which displays following options

Average Cost: Value is re-calculated after every transaction

FIFO (First In First Out): Considers sale of oldest stock first

Last Purchase Cost: Values at latest purchase price

LIFO Annual: Considers sale of latest goods first taking into account the current financial year.

LIFO Perpetual: It is similar to LIFO perpetual but last purchase continues from previous financial year

Standard Cost: As you enter in Stock Item at Standard Rates

Market Valuation Method: While Costing Method Computes cost of Stock, by Market Valuation, you determine the worth of stock. Select the method from the following.

- Average Price

- Last Sale Price

- Standard Price

Ignore difference due to Physical counting? Respond Yes if you want to ignore difference in stock according to books and actual stock that you may enter in Physical Stock Voucher. Before setting to Yes, consider the consequences.

Ignore Negative Balance?

Set to Yes if you want to ignore negative stock balance in stock reports.

Treat all Sales as New Manufacture?

If you follow the principle, all Sales are Manufacture, set it to Yes which will update the quantity manufactured as soon as you enter sales. The advantage is you will never get a report showing Sales in excess of Manufacture / Purchase.

Treat all Purchase as Consumed?

If you follow the principle, all purchases are consumed, set it to Yes. Then you need not keep track of issues and obviously closing stock for the Item will always be NIL

Treat all Rejections Inward as Scrap?

If you treat all stock that comes back as rejected is scrap, set this to Yes.

Allow Use of Expired Batches?

This option is available if you have set for Maintain in Batches and Use Expiry Dates. If you set this option to No, expired batches will not be considered in stock reports nor you can allocate expired batches in Inventory allocations in Voucher Entry.

Godowns

Godown is the place to store Goods which may be a warehouse, Rack, shelf, bin or anything. You can extend this concept even to process / contractor / third party job worker.

If you wish to monitor locationwise movement of stock, you may create Multiple Godowns and while recording transactions you will specify the location, i.e., Godown

Tally 9 allows you to create not only multiple Godowns, but like Cost Centers, you can create sub-Godowns and nest into any level. Thus you can logically build Factories, Warehouses, Shed Numbers, Godown Number, Rack Number, BIN Number etc.

Creation of Godown

Name: Type the name of the Godown

Alias: Alternate name

Address: This option will be available if you set Use Address for Godowns to Yes in the Inventory Masters under F12: Configure. You may enter address for the storage space.

Under: If it is primary level godown, select Primary from the list. If the storage space is under any created Godown, select from list.

Advanced Information

If Allow Advanced entries in Masters is set to Yes in Inventory Masters under F12: Configure, you can input following additional information.

Allow Storage of Materials?

If you do not store any materials directly in any Godown, you may set it to No.

Exclude from Stock Valuation?

If you want materials stored in any godown not to be included in stock valuation, set to Yes.

Unit of Measure

Different items may be measured in various units e.g., KG, Metre, Litre, Box, Carton, Dozen, Set, Piece etc. This options allows you to create all such units.

Creation of Unit of Measure

Symbol: Enter symbol t denote the Unit of Measure

Formal Name: Enter full name of the Unit. It must be different from Symbol

Number of decimal places: If the unit can be expressed as fraction, specify maximum number of decimal places required to express. If any Unit is not fractionable, give 0. permissible range is 0 to 4.

Creating Complex Unit of Measure

If the simple UoM is not sufficient, you may create a complex UoM and specify the conversion factor between them.

Voucher Types

Voucher Types in Tally

By default Tally 9 provides 18 types of Vouchers (with out counting payroll vouchers) for recording different natures of transactions. However, if you require further Voucher Types that function like the one of the existing type, you can create New Voucher Types and give different Voucher Numbering series.

The Voucher Type facility is great as you can make several alternates of each pre-fixed Voucher Type. For example, for Sales Voucher, it may be convenient to have several Voucher Types like Cash Sales, Credit Sales, Sales To Registered Dealers, Sales to Unregistered Dealers, Export Sales, etc. By creating separate voucher types for them, you can independently configure their numbering scheme, layout, etc.

Creating New Voucher Type

Select Create from the Voucher Types menu.

Name: Enter a name for your new Voucher Type.

Type of Voucher: Select the Type of Voucher from the List of Voucher Types. The Voucher you are creating will have similar functions that you select here.

Abbr.: Enter abbreviated short name for the new type of Voucher, preferably within 5 Characters.

Method of Numbering: Select from the list of Types of Numbering that displays following options:

- Automatic

- Manual

- None

Starting Number: Give the Starting number you wish. By default 1.

Width of Numerical Part: Tally 9 on it’s own adjusts the width according to the number if you leave this field blank. To get aligned look in Reports, specify maximum width, e.g., 5

Prefill with Zero? Give Yes to fillup the numbers with zeros. No will leave the space blank.

For example if you give width 5 and the voucher number is 13 then it will be displayed and printed as:

00013

You configure the Voucher Number to be reset at given intervals Daily, Monthly, Weekly, Yearly from the starting Number

You can give prefix or suffix to your Voucher. If you give ‘INV’ as prefix your voucher will be ‘INV00013’

Use Effective Dates for Voucher?

Give Yes if you want to enter Effective dates fro this type of Vouchers. You would opt for this if you have instances where a transaction under consideration for overdue / ageing analysis is recorded but will take effect from another date. If effective date is entered, the overdue/ageing will be considered from the effective date and not from voucher date.

Use Common Narration?

In a Voucher, you can enter multiple entries. If you want common narration for all the entries, set to Yes and No if you do not want common Narration.

Narrations for each entry?

If you want separate narration for each entry, set it to Yes, after each entry in Voucher, you will be prompted to enter narration for the entry. Give No if you don’t want separate narration for every entry.

Print after Saving Voucher?

If you want to print Voucher after saving, give Yes. You will require it for Sales Voucher / Payment Voucher.

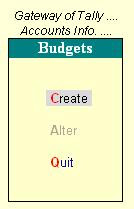

Budgets in Tally 9

Budget

Budgets are used to set targets and compare against actuals and get variances. You can create multiple Budgets for different purposes.

Creating Budgets

Name: Enter a name of the Budget for identification

Under: Like Cost Centres, you can have a hierarchical budget set-up i.e., Primary Budgets and Secondary budgets there under and nest upto any limit. Obviously, the first item should be Primary and then you can place it either under primary or any Budget created by you.

Period of Budget: Give the period range of the Budget in the columns From and To

Set / Alter Budgets of: You will get 3 options to select from

- Group

- Ledger

- Cost Centre

By giving Yes at the Group column, you can set Budget for Groups of Ledgers accounts. Similarly by setting Yes at Ledger or Cost Centre Columns, you can set Budgets for individual Ledger or Cost Centres. You can also set for all of them.

When you set Yes in any of the 3 columns (Groups, ledgers and Cost Centres), a screen will pop-up to input details.

Account Name: Name of the Group for which the Budget belongs.

Cost Centre: You can earmark a particular cost centre for each group here by specifying the Cost Centre. If you want the Budget to be applicable for whole of the organization, select not applicable.

Type of Budget: You get 2 options to select the type of Budget, namely

On Closing Balance

This option is suitable for accounts where closing balance is to be monitored (e.g. personal Accounts) where Nett transactions for the specified period carries least importance. For monitoring Bank Balances, Overdrafts or Party accounts, select this option.

On Nett Transactions

This option is meaningful for Revenue Accounts where Nett transactions need to be monitored

Cost Centres

Cost Centers allows allocating to different Cost or Profit centres. Cost Centres are optional, that is you can do regular accounting without creating any Cost Centre. You can create cost centres in Multi-levels. i.e., Primary, Secondary. The First cost Centre created is always Primary. Subsequent Cost Cenres may be of primary level or may be placed under any existing Cost Centre, there is no limit in nesting.

To activate Cost Centres, you must set Yes to the Question Maintain Cost Centres in Accounting Features under F11: Features.

Create New Cost Centre

Category: Select appropriate Cost Category from pop-up window

Name: Here you type the Cost Centre Name. Duplicate names are not allowed.

Under: Select the parent Cost Centre from pop-up window under which this Cost Centre will appear. To create Primary Cost Centre, Select Primary from pop-up list.

Cost Categories

Cost Categories facilitate to allocate amount to multiple cost Centres in parallel. For example, a company may allocate an amount independently to Salesman, Products & Agents as follows:

Cost Category Salesmen Products Agents

Cost Cenres Mr A Printers M/S. ABC

Mr B Consumables M/S. XYZ

Now an amount of Rs. 3000 may be allocated to:

Mr. A – 1300 Mr. B – 1700

Printers-1600 Consumables – 1400

M/S. ABC – 1800 M/S. XYZ – 1200

Having done like this, now you will get reports of allocated amount accordingly.

To activate Cost Categories, you must set Yes to both the options Maintain Cost Centres & More than one Cost Category in Accounting Features F11: Features.

Name: Type the name of Cost Category. You can not create duplicates with same name.

Allocate Revenue Items: Give Yes to allocate Revenue Transactions (e.g., Sales, Purchase, expenses and income) to cost centres that you will create under the cost categories, specify No if you wish to allocate capital/non-revenue item only to the cost centres under this cost category.

Allocate Non-Revenue items: For revenue cost centres, set it to No. If you wish to allocate Non-Revenue or Balance Sheet items, set it to Yes.

Automatic Interest Calculation in Tally

Interest Calculation in Tally

While creating a ledger account you will get the option.

Activate Interest Calculation?

This prompt appears if you responded Yes to the question Activate Interest Calculations? At F11: Features for the Company. If your response is Yes to that question, you will get another question: Use Advanced Parameters? Giving Yes will activate Advanced Mode and No will restrict to Normal Mode.

If you want interest to be calculated for the Ledger, respond Yes here. You can opt to compute Interest on two methods.

On Outstanding Balance Amounts: In this method, the interest is calculated on outstanding balance. This is normally suitable for Loan Accounts where you compute interest on running balances of the account.

On Outstanding Bills / Invoices / Transactions: This is applicable for ledger for which you have set Bill by Bill option

Calculate Interest Transaction by Transaction?

Give Yes to compute Interest on Bill by Bill basis. If you want Interest to be computed on Balance, respond No.

If you give Yes you will be asked Overwrite parameters for each transaction?

If you want to change Interest parameters during voucher / invoice entry, set Yes. If you want to enforce the parameters as specified in the ledger, give No, and you will not be prompted at the voucher entry

Simple Mode

I will teach you Interest Computations in Simple Mode. Advanced Mode will be discussed in another post.

On Outstanding Balance Amounts

If Bill by Bill option has not been opted for the Ledger, you have to specify Rate of Interest (%) and the Style , from the following

- 30 Day Month

- 365 Day a Year

- Calendar Month

- Calendar Year

This method is suitable for all sorts of loan & deposits accounts like Fixed Deposit, Term Loan, Secured & Unsecured Loan etc. However, it is not suitable for Bank OCC (O/D & CC accounts where the interest is computed as per bank’s own daily balance & not on the basis of you bank book balance.)

On outstanding Bills / Invoices / Transactions

If Bill by Bill option has been opted for the ledger, you will get a screen to define Interest Parameters as shown in picture.

Rate: Specify the rate of Interest in percentage (%)

Per: Select from the options available in popup menu

- 30-day Month

- 365-day Year

- Calendar Month

- Calendar Year

On: Select an option from available Interest Balances popup menu

- All Balances

- Credit Balances Only

- Debit Balances Only

Applicability: Select one from Interest Applicable on pop-up

- Always

- Past Due Date

If you select Past Due Date an additional field by _ days will be there. Give number days.

Calculate from: Select one from Interest Appl From pop-up

- Date of Applicability

- Due Date of Invoice / Ref

- Eff. Date of Transaction

Rounding: Select one from Rounding Methods pop-up

- Not Applicable

- Downward Rounding

- Normal Rounding

- Upward Rounding

If you select any Rounding methods you will be asked for

Limit: Specify the limit fro rounding off (e.g., 0.50)

Tally 9 provides versatile tools to control Interest Calculation and put the control at the user. You may control the applicability and rate beforehand of the transaction and enforce the rule rigidly by not allowing to change the rule on bill to bill basis. This enforces strict rule and you do not have to specify Interest for each Bill. The Interest Computation is governed by the rule set in the Ledger Account.

On the other hand, if you do not like to enforce uniform rate for all the bills relating to the ledger, you may allow to enter interest rates for each bill.

Ledger Creation in Tally

Ledger Accounts Creation

Once you have created all the Accounts Groups, you are now ready to make entry for Ledger Accounts. To do, first arrange the Ledger Accounts and note down which ledger account is to be placed under which Group. Previous year’s Final Accounts may also be of help. There are two Reserved Ledger Accounts, Cash and Profit & Loss a/c. that are created by Tally 9 when you create a Company which you can not delete nor you can move them under any other Group.

Single Ledger Creation

Name: Type the new Ledger’s name here. Duplicate in name is not permitted.

Alias: Alternate names for you ledgers. This is optional.

Under: Select the Group under which this Ledger Account falls. You will get a pop-up window from which you can select the appropriate Group. To create a new Group press ALT+C which will bring Group Creation Screen. When you have created the Group, cursor will return to this place accepting newly created Group as default.

Opening Balance: Enter the opening Balance as on the date of Books Beginning From. Normally the Opening Balance of Revenue Accounts will be Zero unless you start from middle of the Financial Year. If your books begin at mid-year i.e., dates fro Financial year from and Books beginning from are different, enter closing balance of previous date as opening balance here for all capital and Revenue accounts.

Cr/Dr: If opening Balance figure is not zero, specify whether the amount is Debit or Credit.

Mailing & Related Details

If you have set Yes o ‘Allow Addresses for Ledger Accounts’ under F12: Configure, you can enter Mailing & related details for Ledger accounts under Sundry Debtors, Sundry Creditors, Branch/Divisions, Loan, Loan & Advances groups.

If you have set Yes at the ‘Use Contact Details for Ledger Accounts’ Under F12: configure, you get additional prompts to input Contact Person, Telephone, Fax Numbers etc.

Advanced information

If you have set Yes to Allow Advanced Entries in masters under F12: Configure, you get a screen with options configured by you.

Maintain balances bill-by-bill?

If you have set Yes in F11: Features to Maintain bill-wise details, then this option appears

- While creating any ledger placed under Sundry Debtors or Creditors Group, you may specify yes to keep bill-wise details for the ledger

- Similarly, you can specify Yes to other ledger accounts also, if you had specified Yes to For Non –Trading A/c also in Accounting Features under F11: Features

Specify No, when you do not need to maintain bill-wise details of outstanding balance but like to get ledger balances only. The input becomes simpler and you do not have to enter the bill-wise details of the Opening Balance as described below.

If you have specified Opening Balance and have opted for bill-wise details, then you may specify bill-wise details of Opening Balance in the popup box where in first field you enter date of Bill, next enter Bill Reference, Credit Days/Due Date in next field, amount of Bill outstanding and Debit or Credit in the last field. You may however, leave the full or part of the opening balance amount as On Account.

Cost Centres Applicable?

You get this option if you had set yes to Maintain Cost Centres in the Accounting Features under F11: Features. You may selectively specify Yes (or No) to the respective ledgers where you want to allocate the amount to Cost Centres/Cost Categories.

Inventory Values are Affected?

Specify Yes to ledgers like Sales / Purchase which affect Inventory. If any duty of Direct Expenses affects your inventory, you may set to Yes for such ledgers.

Percentage of Calculation

If you have set Allow Invoicing in the Accounting Features under F11: Features and if the Ledger is placed under Duties & Taxes Group or any other Group for which you responded to yes to the Query Used fro Calculation? Then you may specify the rate of Tax (%). On specifying rate, you have to select the Method of Calculation from the list of Types of Duties.

- Additional Duty

- On Total Sales

- Surcharge on Tax

- Tax based on Item Rate

Additional Duty

Under F11: Features, if you disable Excise Rules, Additional Duty and Surcharge on Tax functions similarly. If enabled, Additional Duty is added to the Tax based on Item Rate in the Invoice to reflect the Total Duty Payable.

On Total Sales

As the term suggests, this type of Duty will be calculated on the Total value of individual items ignoring the rate of Duty specified for each item in Stock Item Master.

Note: If you have responded yes to the question Calculate Tax on Current sub-total? In the Invoice/orders settings under F12: Configure, then the calculation will be on current sub-total and if set to No, it will calculate on Total value of Inventory Only.

Surcharge on Tax

A surcharge is treated as a percentage of the duty levied and is computed on immediately preceding entry. The Tally software presumes that the preceding line in the Invoice is the Duty on which surcharge is to be computed. This is suitable for taxes or duties like of Additional Excise Duty that is computed on the Tax (or Duty) amount.

Tax Based on Item Rate

If rate of Tax or Duty is directly associated with items which again differs from item to item, this type of Duty will be most suitable.

While creating Stock items, you get a field to specify Rate of Duty, where you may specify rate of Duty applicable for the Item.

When you select this Type of Duty for the Ledger, while preparing Invoice the rate of duty specified in each item will be picked up and computed. If more than one rate of Duty is applicable in single Invoice amount for similar rate of duty will be clubbed.

During Invoice Entry, the Tally software will automatically compute the Tax/Duty at the specified rate as per specified method which can however be modified.

Activate Interest Calculation?

This prompt appears if you responded Yes to the question Activate Interest Calculations? At F11: Features for the Company. If your response is Yes to that question, you will get another question: Use Advanced Parameters? Giving Yes will activate Advanced Mode and No will restrict to Normal Mode.

Here is the complete tutorial on Tally 9 Interest Calculation

Effective Date for Reconciliation:

When you create any Ledger under Bank Accounts (or Bank OCC) Group, this prompt appears displaying books beginning date as default. Enter here the date from which you want to reconcile the Bank Accounts.

Specifying Closing Stock Value

In Case of creating new ledger Accounts under stock-in-hand, you can enter only Opening Balance. You should enter figures of closing stock through Alteration mode which allows you to specify date and closing balance for that date.

Note: Date wise closing Balance is available only in Ledger Alter menu only. Once you create the stock ledger. Go to alter select the ledger and give closing stock values.

If you maintain non-integrated accounts, Balance Sheet as on this date will reflect the closing balance that you specify here. However if you maintain integrated accounts, you can not enter closing stock value through this option.

Credit Limit

For Ledger created under Sundry Creditors, Sundry Debtors and Branch / Divisions you get additional option ‘Set credit Limit:’ you can specify the credit limit amount for such ledegers.

Default credit period (in days) will be asked for these ledgers if you have given yesto Maintain balances bill-by-bill?

Alter

In this option you can change the contents of any existing ledger.

Note: To enter opening balance in an of the built-in ledger Accounts (Cash A/c, Profit & Loss A/c) select the Ledger in Alter mode and type opening balance.

To Delete a Ledger, first select the ledger from the pop-up in Alter mode, then press ALT+D keys, a confirmation box will appear. To confirm, press Y, the item will be deleted. However, if any voucher has been placed under the ledger, it can not be deleted as long as any Voucher is associated with the ledger. If you still want to delete the Ledger, list the vouchers which are associated with the Ledger through and option in Display mode, alter the voucher or delete the voucher. When there is no voucher contain the ledger to be deleted, you will be permitted to delete the Ledger. This Deletion concept applies to all masters.

Group Creation in Tally

Account Groups

Account Groups provide you the ability to organize you Accounts. You can classify all ledger based on their functions. When you create a ledger, you have to put it in an appropriate Group depending on its nature of function. This classification is known as Grouping of Ledgers which determines whether the ledger goes into the Profit and Loss account o into the Balance Sheet. Grouping of ledger determines the type and amount of Information you can get.

Tally 9 provides a set of pre-defined Groups. You can use these Groups readily for classification of ledgers, without creating new Groups or you can create Groups under and of these Groups and place ledger under these Group or create new primary Group. You create multi-level Group one under another to any level.

Create New Group

Select Create under Single Group menu Groups menu, a screen appears to create a new Group with following fields as in picture.

Name: Type the name of the Group. You can not give duplicate name.

Alias: Give additional name(s) for the Group.When you select Group you can refer to it either by Name or by Alias. Alias is optional but Name is compulsory.

Under: When you reach this field a pop-up window will open and show all the existing Group heads. Select the parent group under which the Group being created should be placed. You may select any from the existing Group by pressing ALT+C which will bring Group Creation screen to create parent group of the group you are currently creating.

Creation of Primary Group

You can create a Primary Group if Allow Advanced Entries in Masters is set to Yes. While creating New Group, select Primary at Under, then select the nature of Group from the following 4 items

- Assets

- Expenses

- Income

- Liabilities

If you select Expenses or Income, you have to additionally specify whether this Group affects Gross Profit or not by appropriately responding Yes / No

For example, you may crate Groups like Depreciation, Interest on Loan, Selling Expenses etc. in primary Group. The advantage of Primary Group is that you can configure the Group nearer to your requirements than the default Reserved Groups provided by Tally 9.

Tally 9 Lesson 3

Tally 9 Lesson 3 - Accounts Master

After company creation & configuration, first you should create the necessary Masters for Ledgers and Inventory Items.

Masters are placed under 2 Menu Items at Tally 9 Gateway, namely

- Accounts Info

- Inventory Info

The common fields in all the masters are explained below.

Name: to enter Name of the Master. You can enter long names (51 Chars. Max.)

Alias: It is an additional name for the Master, a sort of nickname. For example, If you call any Ledger or Group or any other Master by another name, enter it. You can select the item either by name or by Alias. For example, sometimes you refer to the ledger ‘Bharat Sanchar Nigam Limited’ as ‘BSNL’, so in name give Bharat Sanchar Nigan Limited and BSNL as alias. If you use codes, you can give Codes in alias. You can create multiple aliases for one master. Alias is optional, and you can leave it blank.

Single & Multiple Masters

Except for Budget, Voucher Types, Currency and Unit of Measure, for all other Masters under Accounts Info and Inventory Info menu, Tally 9 provides twin options for Creation, Alteration and Display, namely (1) Single option (2) Multiple option. In Multiple option all normal fields for multiple masters appear in columnar format – a convenient way to create many masters at one go. In Single option, you create each Master Individually.

Conversion of Name

When you type in lower case, Tally 9 automatically converts the first letter of every word of the name to upper case, to save time in typing. So, you may conveniently type a abc & co. and Tally 9 will convert it into ABC & Co.

Duplicate Name

You can not create duplicate masters or duplicate aliases. An alias of one master can not be the name of another master. While considering duplicates, Tally discards some punctuation marks (like -,/,(,)). So ABC (Pvt) Ltd A.B.C Pvt Ltd are same.

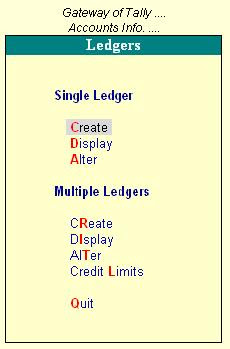

Accounts Info

Each menu has sub-menus. Let’s view all the menus and sub-menus that are available under Accounts Info menu before taking up options individually

Groups

Single Group

- Create

- Display

- Alter

Multiple Groups

- Create

- Display

- Alter

Ledgers

Single Ledger

- Create

- Display

- Alter

Multiple Ledgers

- Create

- Display

- Alter

Cost Categories

Note: This Master is not activated by default. Go to features (F11) -> Accounting Features - > Give Yes to Maintain Cost Centres.

Single Cost Category

- Create

- Display

- Alter

- Create

- Display

- Alter

Cost Centres

Single Cost Centre

- Create

- Display

- Alter

Multiple Cost Centres

- Create

- Display

- Alter

Budgets

Note: This master is not enabled by default. Go to Features (F11) -> Accounting Features -> Maintain Budgets and Controls

- Create

- Alter

Currencies

Note: This master is not enabled by default. Go to Features (F11) -> Accounting Features -> Allow Multi-Currency:Yes

Voucher Types

- Create

- Display

- Alter

Here is an explanation about Masters under Accounts Info menu

Accounts Group: Account Groups for classification of accounts. A set of pre-defined Groups are already available. Your created Group can be placed under any of the pre-defined groups or you can also create primary group. You can nest Groups up to any level.

Ledger Accounts: ledger accounts are the only essential masters for entering Accounting transactions.

Cost Centeres: Cost Centres allocate the figures of ledger accounts into entities like Departments, Projects, Salesman, etc

Cost Categories: Cost categories provide parallel Cost Centres, to allocate figures into many Cost Categories

Budget: You can set multiple budgets, compare against actual & get variances.

Voucher Type: Tally 9 provides some pre-defined voucher types, which in normal cases are good enough to record all types of transactions. However, you may add more sub classification of voucher types under any of the pre-defined voucher types. Enter your own voucher types through this part.

Now we will have a look at Accounting Features in Tally (F11:Features):

What is Maintain Bill-wise Details Feature?

If you want to maintain Bill-wise break-up for any ledger, set Yes, then this feature will be activated and you will be prompted to specify individually when you create any ledger whether you wish to maintain Bill-wise details for the ledger.

(for Non-Trading Accounts also?)

If you want Bill-wise tracking for other accounts also (besides Sundry Creditors & Sundry Debtors), set Yes, then this feature will be activated and you will be prompted when you create any ledger whether you to maintain Bill-wise details for the ledger.

Normally you need the Bill-wise details only for Sundry Debtors & Creditors. So, to keep things simple, set this option to No.

Maintain Cost Centres?

Respond Yes if you want Cost Centres, then Cost Centres will be activated and will be made available in Accounts Info Menu.

Use Rev. Journals?

Respond Yes if you want to use Reverse Journal Vouchers, then it will be available in Voucher by pressing F10.

Reverse Journals are needed to make Transient Journal Vouchers to get intermediate PL & Balance Sheet, after adjustments like Liabilities, Interest, Depreciation etc. you do not need to set this option just to get Monthly / Quarterly Trial balance etc.

Use Debit / Credit Notes?

Respond Yes if you want to use Debit and Credit Note Vouchers, then it will be available on pressing F9 and F8 in Voucher Entry Screen.

(Use Invoice mode for Credit Notes?)

If you want to enter Inventory details first from which the accounts data for Credit Not is built up, set this option to Yes, otherwise set No.

Activate Interest Calculation?

To calculate Interest for Ledger Accounts, set this option to Yes, to activate the Interest Calculation Option.

(Use advanced parameters?)

This options allows to set special rules for Interest Calculation

Normal and Advanced Information

Information in Masters are classified into 2 modes: Normal and Advanced. Normal information can always be entered. Advanced Information can be entered only if ‘Allow Advanced entries in masters? Is set to yes in Accts / Inv Info under F12: Configure

Note: The changes you carry out in F12: Configure are global, that is it will be effective for all companies you are working with Tally. So if you are working with multiple companies changing a Configuration will affect all companies whether you want or not.

Many thanks for your blog post. Good Resources for All. Thanks guys just visiting my website.

ReplyDeleteTally Services

College tuition prices are rising every year - faster than almost any other expense. The bad news for students is that post-graduation salaries have been practically flat. Thanks to specific government policies, there's very little chance that tuition costs will soon be coming back down. A Team Tuition

ReplyDelete